The ACCC has today published its draft report detailing its market study of the communications sector, which includes 29 recommendations spanning a wide range of competition and consumer issues in communications markets.

The year-long market study has seen the ACCC release an issues paper and consult with a wide range of industry participants and consumers, including considering 64 submissions and over 1000 responses to a consumer questionnaire and hosting a two-day industry forum.

“We’ve undertaken this market study to deepen our understanding of the communications market, and to make sure we have the right tools to address market failure, promote competition, and benefit consumers,” ACCC Chairman Rod Sims said.

The market study found that there is strong price competition between the major service providers despite considerable concentration in both fixed and mobile retail markets. This will increase with TPG launching its own mobile network and Vodafone offering services over the NBN.

“Overall, we consider that our regulatory framework remains fit for purpose in addressing current and emerging issues, and in ensuring that the long term benefits of competition are realised. However, the study has highlighted a number of areas of consumer concerns which will benefit from some immediate actions,” Mr Sims added.

“The key recommendations stemming from the report are on connection and activation issues as consumers transition to the NBN, NBN pricing and speed claim issues, the competitiveness of smaller service providers and issues flowing from new technology such as 5G.”

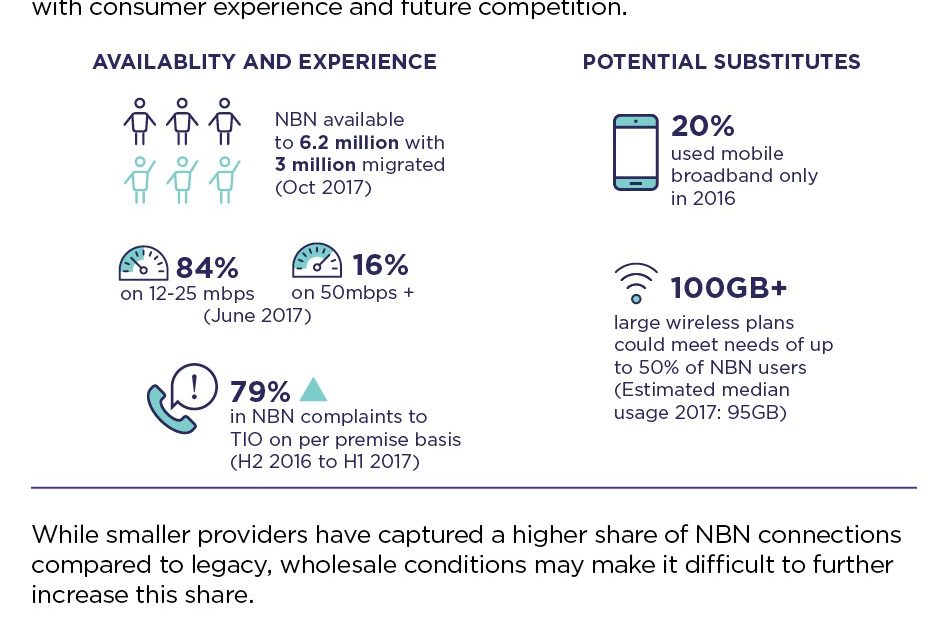

The study has highlighted consumer experience issues around connecting to the NBN and fault rectification. The ACCC is concerned that NBN wholesale service standards are precluding consumers from obtaining redress in the event of delayed connections and faults.

“We are examining the terms of access, particularly the service standards being proposed for access to NBN services. In particular, we will examine incentives in place along the supply chain and whether they are sufficient to support appropriate outcomes. If they are not, we will have to consider whether a regulatory response is necessary to improve service for consumers,” Mr Sims said.

“A key issue the ACCC examined closely is the experience of consumers with slower-than-expected internet speeds, including NBN Co’s pricing of the services it provides to RSPs.”

“From a consumer perspective, the ACCC has concerns that the level of CVC provisioning is contributing to poor speeds being experienced by households and businesses. Retail service providers are also saying that CVC pricing is affecting the uptake of higher speed services by consumers,” Mr Sims said.

Advertising by RSPs and consumer understanding of new broadband plans as the roll out of the NBN progresses remains a problem.

“While we think it’s great that consumers have a wide choice of plans, we want to ensure they have accurate information and tools to help them understand how to choose the best service for their needs.”

The ACCC has two significant initiatives underway to improve the accuracy and clarity of information on broadband plans. Guidance to retailers on broadband speed advertising claims has been published recently and its broadband performance monitoring and reporting program.

“Where appropriate we’ll be following up with enforcement action to address serious or systemic failures in advertising,” Mr Sims said.

“A key step in resolving these issues is NBN Co’s current consultation with the industry on its pricing structures which the ACCC will monitor closely. We would prefer an industry led solution, and we have delayed our decision on NBN Co’s Special Access Undertaking (SAU) to facilitate this.”

“In the medium term, if these issues persist, despite improved advertising and pricing, the Government should consider whether NBN Co should continue to be obliged to recover its full cost of investment through its prices.”

The market study has found that the competitiveness of smaller service providers may be impeded by their access to key wholesale inputs used to offer services on the NBN, such as aggregation services. While these wholesale markets may evolve, the ACCC is considering how to ensure these inputs are available to smaller providers on competitive terms.

“We think there could be a transitional role for NBN Co to provide a targeted aggregation service to smaller providers to support their entry and expansion during the rollout period.”

The market study also notes the rapid pace of technological development including investment in data centres, content delivery networks, cloud services, the Internet of Things and the anticipated rollout of 5G.

“5G will offer significant opportunities for industry and consumers. It may also disrupt existing business models, for example, increasing substitution from fixed internet services to wireless,” Mr Sims said.

“While wireless substitution may affect the ability of NBN Co to recover its costs, the ACCC does not see a case for regulation that constrains this competition with the NBN. It is for this reason we wouldn’t support the Regional Broadband Scheme levy being extended to wireless.”

The ACCC is seeking comments on the draft report by 8 December 2017. The ACCC expects to release a final report in early 2018.